[spacer height=”20px”]

As a history teacher, my job is to spin all kinds of otherwise dead-and-gone facts into middle-school friendly topics. I suppose you might say that my interest in creativity is not only spurred on by a love for the arts, but also from the day-to-day challenge of turning boring information into relevant and interesting lessons for teenagers. The curriculum this week in 7th-grade Texas History landed my classes on “The Principles of Republican Government”, a rather riveting subject that almost always opens the portal into Ben Stein’s high school Econ course in Ferris Bueller’s Day Off. “Republican Government”, mind you, is not meant to be the lopsided view of politics that it has become in the adult world, but rather a factual study of the type of government that was so intricately constructed by our Founding Fathers. As part of the teaching, students are required not only to identify the principles that make-up a republic, but they are also required to understand the strengths and potential weaknesses of said principles. When writing a lesson plan, I always attempt to call on my right-brain with the hope that it might prevent my left-brain from hijacking the classroom and turning Santa Anna’s Siesta into a History Alive! project, complete with desk-drool and a scathing red-mark on the forehead.

As I sat thinking about all the points that needed to be covered, my brain stumbled (or digressed) onto the problem of national debt, a pickle all too pertinent to our republic. Being a movie-lover, I was immediately reminded of Dumb and Dumber. Lloyd Christmas and Harry Dunne have an arguably fortuitous run-in with a briefcase full of cash – ransom dollars, “blood money.” Lloyd and Harry have no idea that by holding onto the briefcase, they are putting their lives in danger. Instead, they celebrate their good luck with a run of brash and unbridled spending. New suits, new cars, a new life on the rise… Lloyd and Harry hit it big and weren’t looking back. But, how would they repay the owner of the briefcase whose money they had “borrowed” and spent? “IOU’s!”

Lloyd: “That’s as good as money, sir. Those are IOU’s. Go ahead and add it up. Every cent is accounted for…”

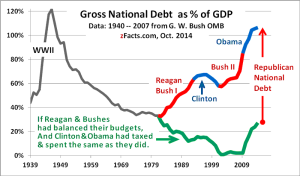

“Every cent is accounted for,” he assures. Ironically enough, Dumb and Dumber were echoing the same thing Uncle Sam has been echoing to the American people for decades. In fact, every cent to the tune of nearly 19 trillion dollars is accounted for. What does that mean as far as repayment goes? Nothing. A s of the time of this writing, the U.S. government is set to collect 3.4 trillion dollars in revenue in 2016. The federal budget is slated to cost roughly 3.9 trillion dollars, adding about a half-trillion more dollars to an already unfathomable debt crisis.

While the latest figures are in fact an improvement when compared to previous years (e.g. 2010 deficit: 1.29 trillion dollars), there is no solution in sight, and no presidential candidate or any other elected official is talking about this Herculean elephant-in-the-room. Instead, they continue borrowing money from a wide variety of cash sources, not the least of which includes printing new money through the Federal Reserve (also known by its American euphemism: “quantitative easing”), an action resulting not only in the devaluation of American money, but one that also accrues debt for the number of dollars printed alongside the interest charged by the fed for the printing service.

As a lover of history and the arts, I realize I am the diametric opposite of a mathematician, but you don’t exactly have to be Euclid to see that America’s budgetary model is designed for failure. As the 2016 election closes in, the U.S. will wrap up one of the most interesting presidential races the country has ever seen. And while it is difficult to back any candidate for fear that he or she may be leading the electorate astray, I find myself more and more inclined to focus on the economic issues, looking for the person who seems most fit to redirect the methods with which we collect and spend money. While certainly debatable and important, most weighty social issues, tend to trail behind the primary impetus for governmental policy: money. As goes the economy, so goes society (for the most part).